Column 007

Medical Device Reimbursement Assessment Categories

Under Japan’s insurance scheme, the manner in which medical devices are reimbursed and priced depends on its reimbursement assessment category.

Medical devices within the A1, A2, and A3 categories covered within the technical fee for specific procedures and cannot be reimbursed separately

Medical devices within the B1, B2 and B3 categories are referred to as Specialty Treatment Materials that are directly reimbursed separately from technical fees based on reimbursement prices set by technical category

Medical devices within the C1 and C2 categories are,

similar to B category devices, directly reimbursed

separate from any technical fees. However, as they do not fit

existing technical categories upon approval,

the creation of a new technical category is required. Furthermore, C2 medical devices also require the creation of a new technical category as well

B3, C1 and C2 medical devices require approval by the Chuikyo

Column 006

Medical Device Supply Chains in Japan

In general, medical devices are supplied to medical institutions (customers) through distributors (dealers). Distributors play a crucial role in providing an extensive technical support for healthcare professionals in collaboration with medical device manufacturers.

Column 005

What is the National Health Insurance (NHI)?

Japan has a universal health insurance system, which means all Japanese citizens and residents must be enrolled in and pay premiums based on income and number of people in the household for some form of public health insurance. Public health insurance schemes are designated according to employment status, age, and residence.

One type of public health insurance is the National Health Insurance (hereinafter referred to as NHI). NHI covers everyone not insured by employer-based health insurance or health insurance for people aged 75 and over. When visiting a hospital or clinic, Enrollees show their health insurance card at reception, they pay only their share at the counter, and NHI pays the rest directly to the provider.

Column 004

What are the Registered Certification Bodies (RCBs) ?

For devices that require “Certification by a registered certification body”, the product must be certified by a registered certification body (RCB).

RCBs are third-party entities accredited by the MHLW to review and certify medical devices. They play a significant role in:

●Product review

Evaluating the device against Japanese Industrial Standards (hereinafter referred to as JIS).

JIS are the standards used for industrial activities in Japan, coordinated by the Japanese Industrial Standards Committee (JISC) and published by the Japanese Standards Association (JSA).

●QMS audit

Conducting a Quality Management System (QMS) audit of the manufacture's facilities to ensure compliance with MHLW Ministerial Ordinance No.169 (2004) titled "the Ministerial Ordinance on Standards for Manufacturing Control and Quality Control for Medical Devices and In-Vitro

Diagnostics“ (hereinafter referred to as MHLW MO169).

The Japanese medical device Quality Management System requirements are stipulated in MHLW MO169.

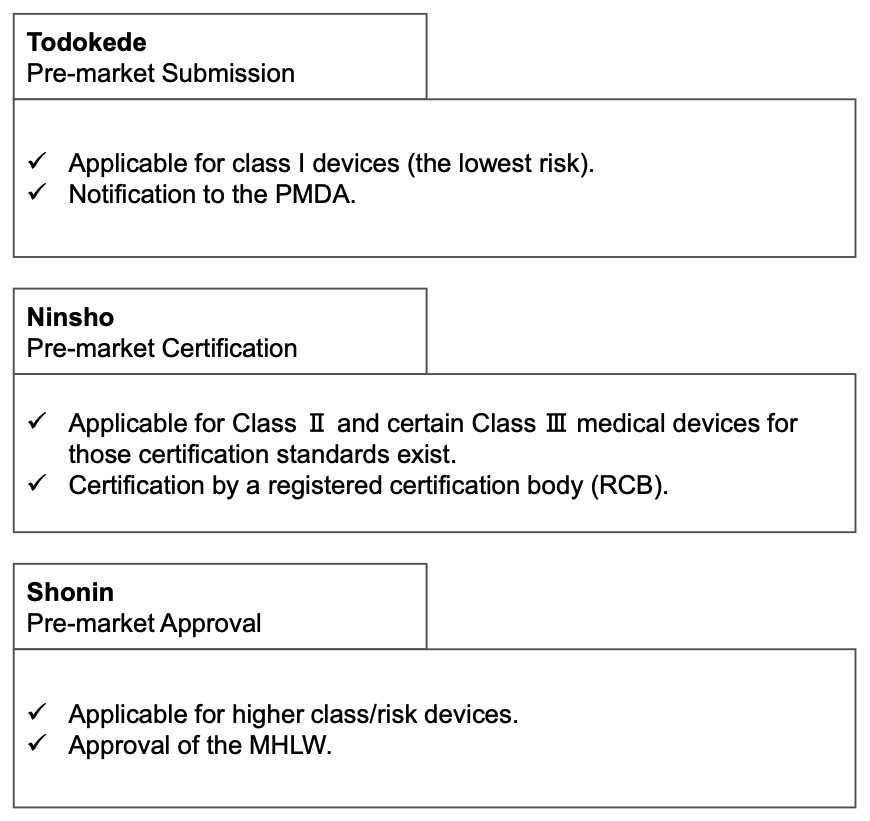

Column 003

Medical Device Registration pathway in Japan

There are three main routes for medical device registration in Japan.

Column 002

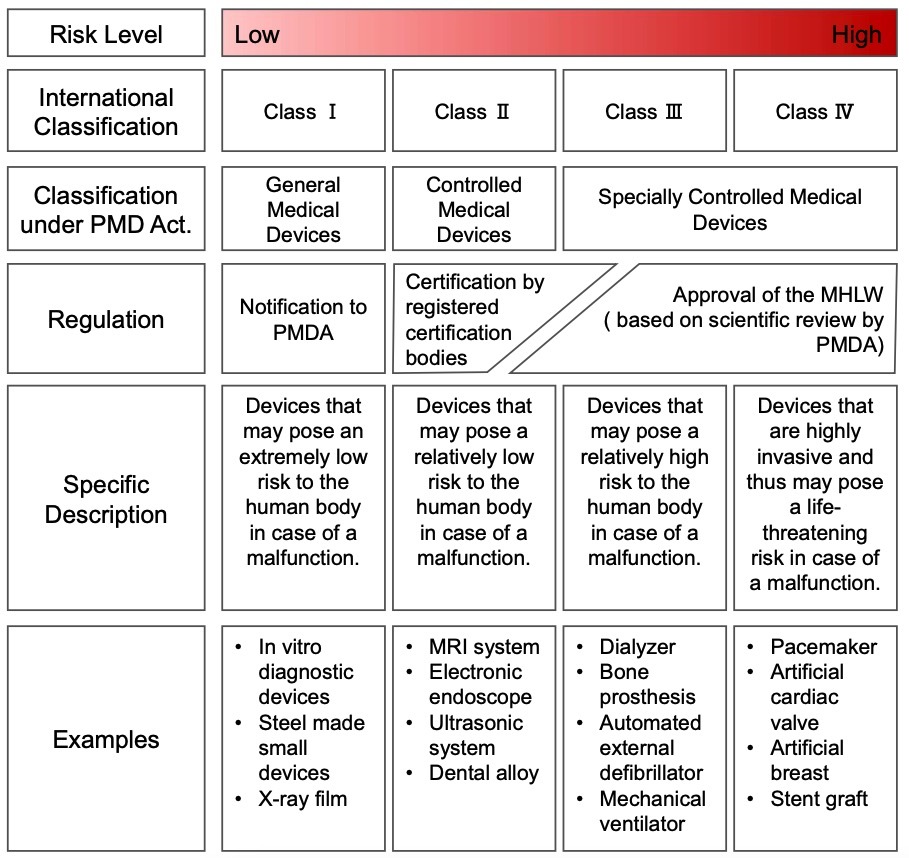

Medical Device Classification and Regulation in Japan

Medical Devices are classified into 4 categories based on their intended use and safety risk.

Pre-market regulatory process for Medical Devices differs depending on the classification.

Column 001

Overview of the medical device industry in Japan

Japan’s market for medical devices continues to be among the world’s largest. The global market for the medical device industry was worth approximately $517.6 billion in 2023, with the United States accounting for approximately 47% and Japan accounting for approximately 5%. It is projected to grow to approximately $654.3 billion by 2027 with an expected expansion at a compound annual growth rate (CAGR) of 5.9% in the 2018–2027 period. The Japanese medical device market is growing at a CAGR of 3.7%, and although this growth is not as large as in other regions, it is expected to be a market of approximately $38 billion by 2027. Japan’s medical device market depends heavily on imports, especially therapeutic medical devices. This trend is likely to continue in the future.

In order to market medical devices in Japan, a foreign manufacturer has to obtain approval/certification or submit notification, depending on the classification, pursuant to PMD Act, through a Japanese Marketing Authorization Holder (MAH) or a Japanese manufacturer appointed by such foreign manufacturer.

Please contact us directly at info@braincraft.co.jp

or through the form under the CONTACT section of this site.